Scotia Bank Cheques Explained

Dont pay more fees than you have to.

Scotia bank cheques explained. Order cheque books online. The service fee is 0 if the account is paperless. The branchtransit number is the 5 digit number that identifies your financial institutions branch. Cheque or other debit item returned for insufficient funds nsf 4800.

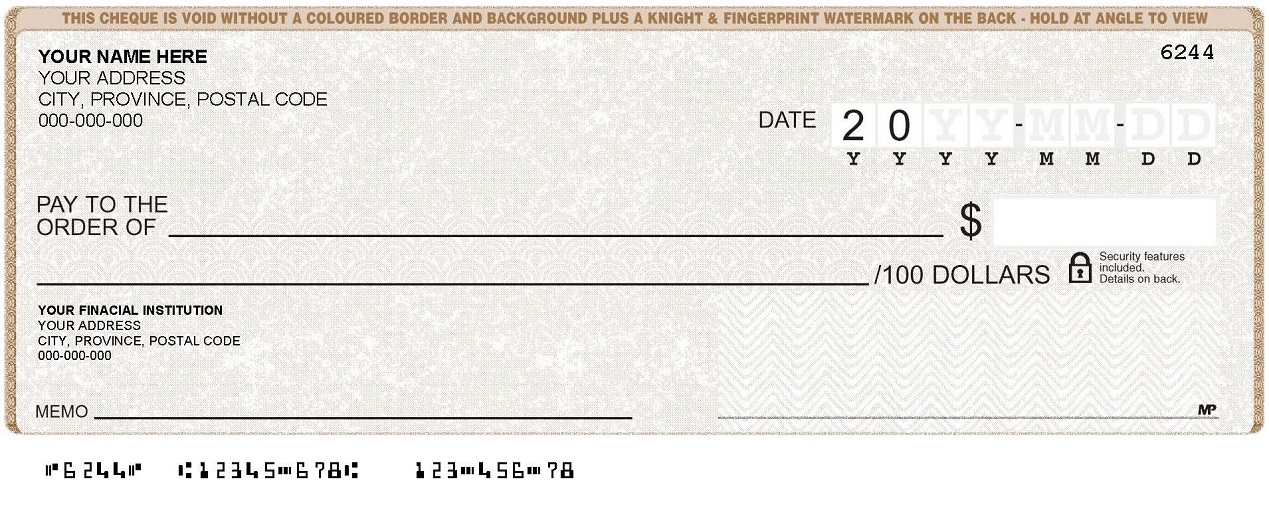

Your financial institution 456 main street your town province ili memo your name 123 any. Cheque images are only available for cheques processed in the last 90 days. Visit your branch for cheques processed more than 90 days ago. Small medium 30000 large 35000 ex large 40000.

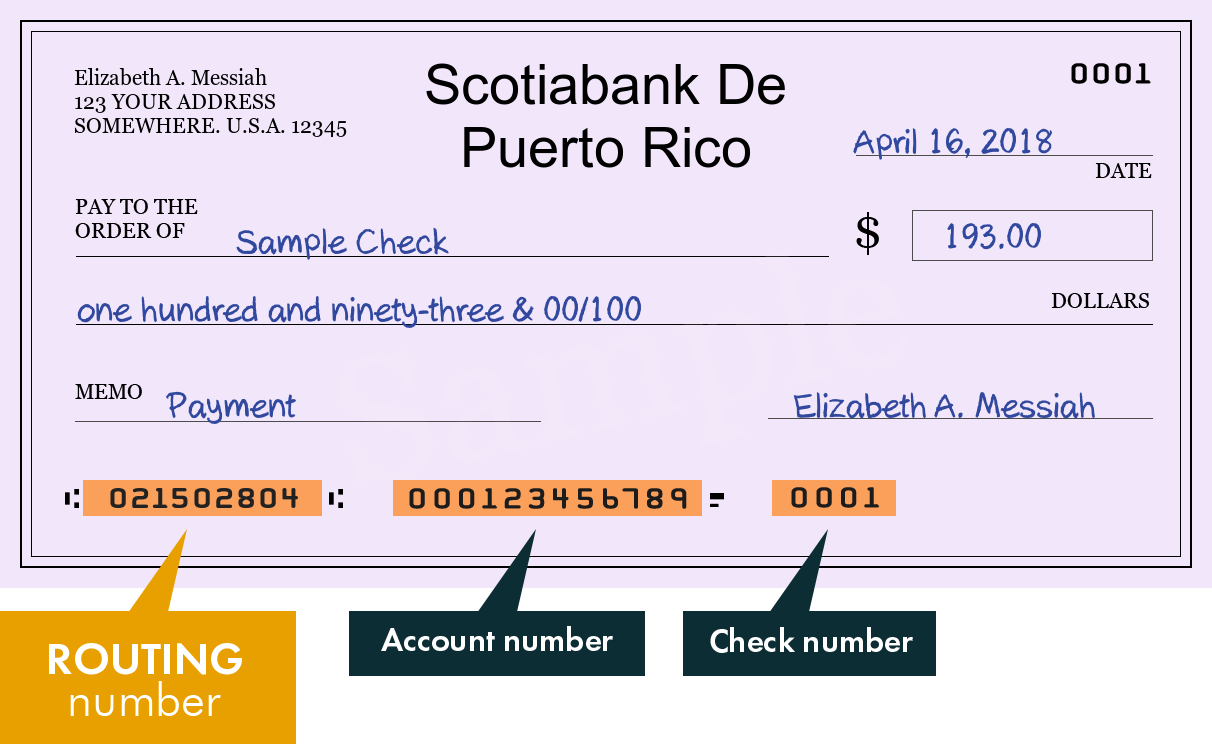

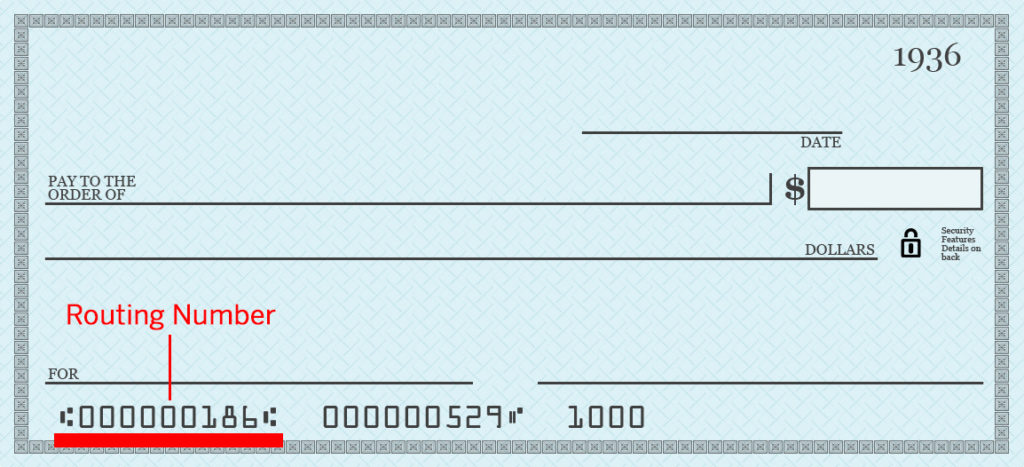

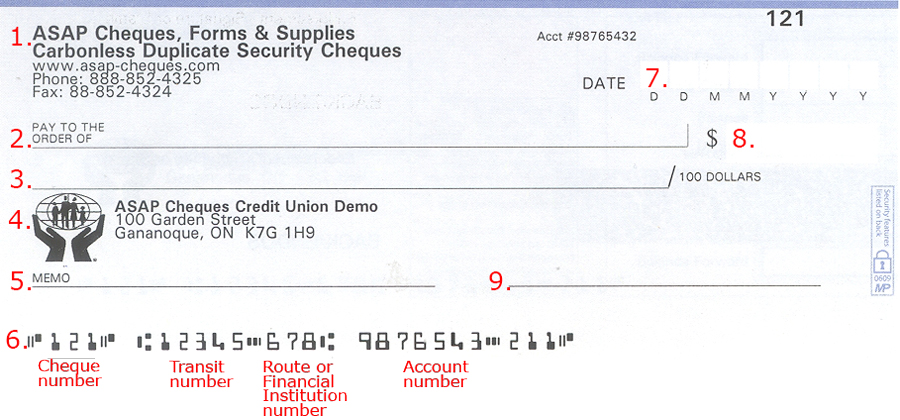

Automatic savings plan asp scotiabank home savings plan shsp education savings plan esp scotiabank savings reward plan ssrp tools advice. Each cheque or pre authorized debit deposited and subsequently returned for third part items deposited to your account no charge. Cheque number do not enter this number transit number 5 digits account number bank number 3 digits all these numbers are used the name and address on cheque must match the name and address on the customer agreement. Choose the best service for your lifestyle.

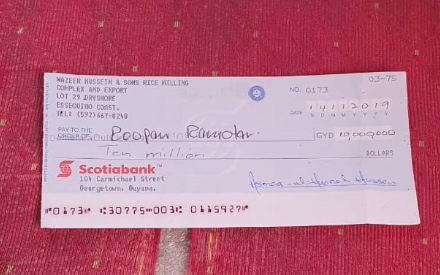

Identifying financial institution account information. Cheques 2000 managers cheque 2500 foreign drafts 3000 purchase of foreign cheques 600 nsf cheque 3500 stop payment order 3500 accounts closed within 3 months 2500 safety deposit boxes. How to read account information from a cheque sample cheque from customer. Savings foreign currency.

The service fee to view a cheque image online is 150 per image request. Scotiabank offers cheque image services cheque book ordering direct deposit overdraft protection and safety deposit boxes. In order to fund your myltsa enterprise deposit account using automatic or manual funds transfer you will need to enter your branchtransit number financial institution number and bank account number in the fields provided. Processed through a scotiabank account.