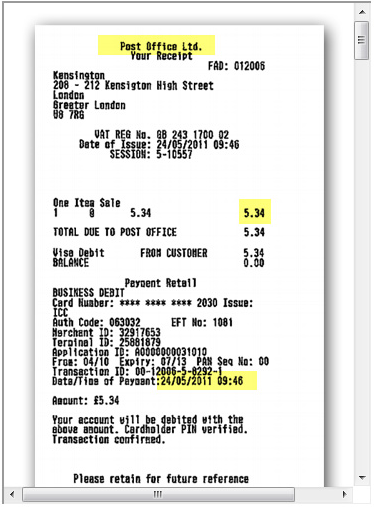

Bank Transaction Receipt

This all will be on a piece of paper with the name and logo of bank from whose atm you are transacting and the name of your own bank.

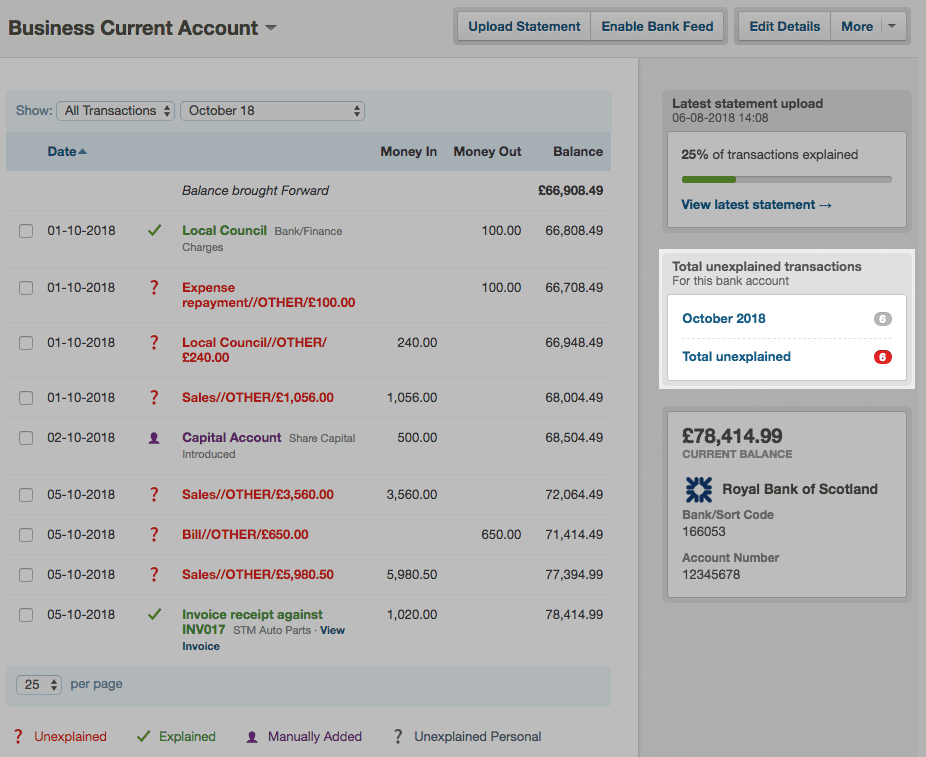

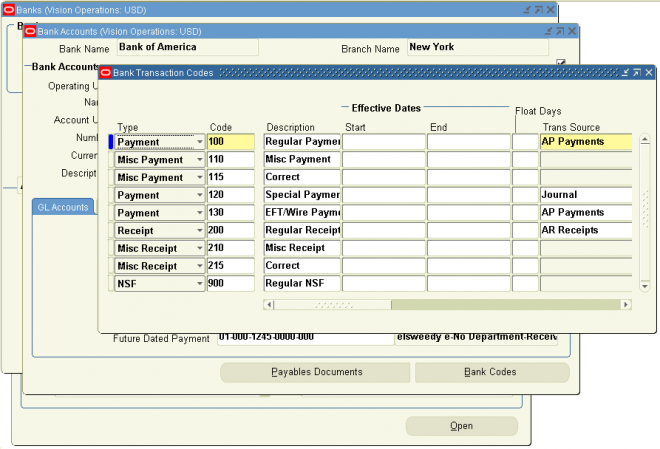

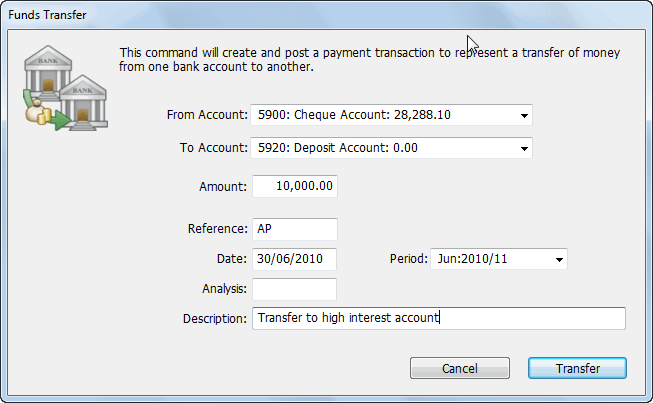

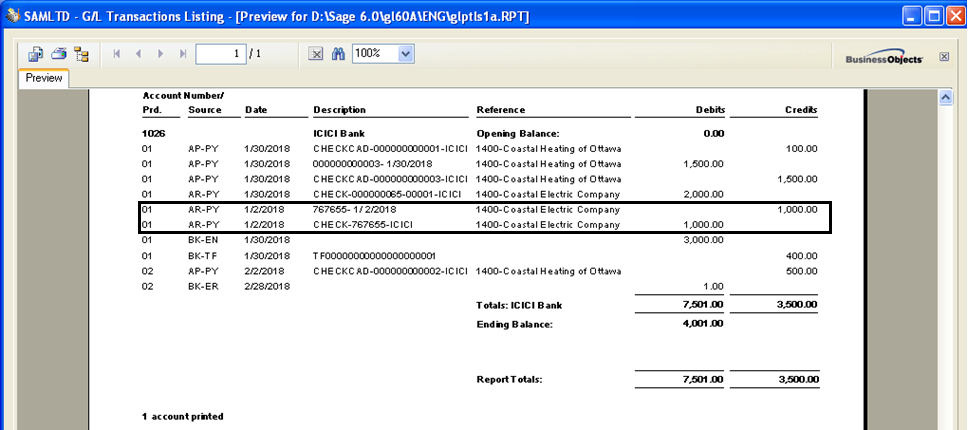

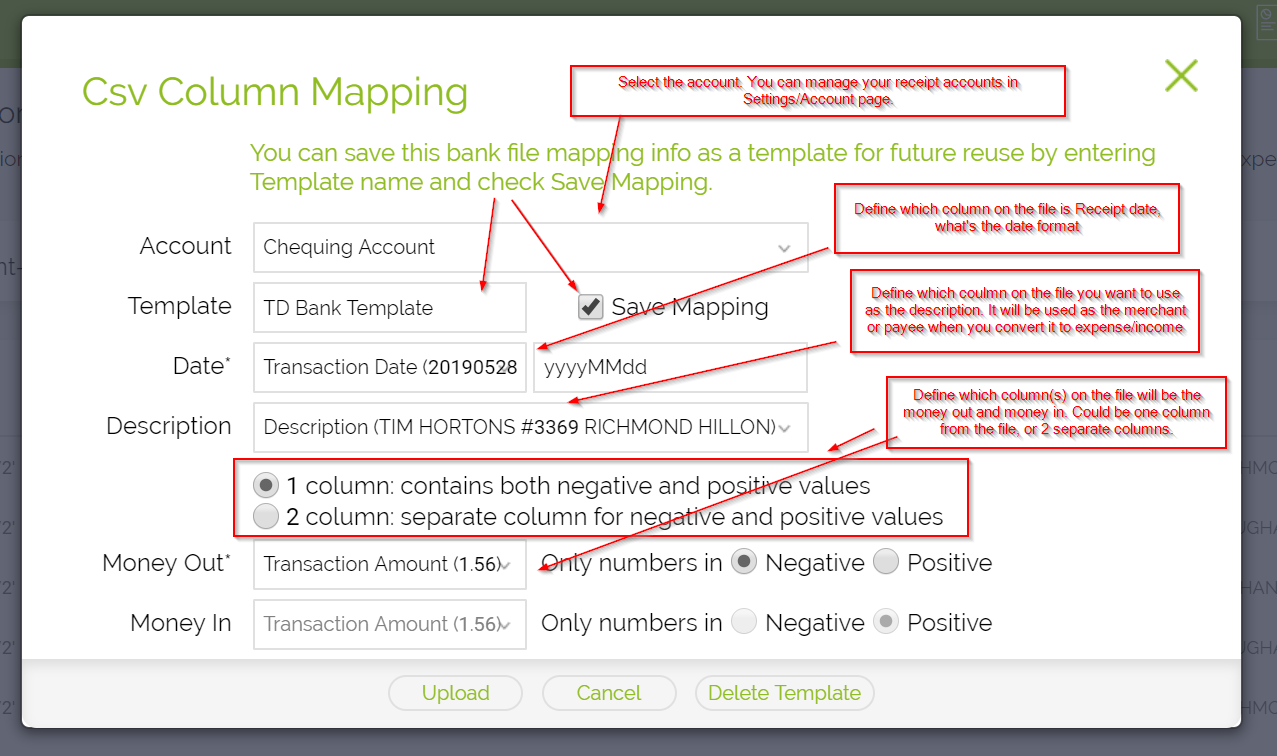

Bank transaction receipt. Without receipts enters a transaction to the checkbook only has no gl or sub ledger impact. Use the information in this microsoft dynamics gp bank reconciliation transactions article you can ensure that your checkbooks accurately reflect the transaction detail that appears on your monthly bank statements. You can enter the transactions to update your cash account and checkbook balances to enter receipts and deposits and to reconcile your checkbook. Mentorjay thank you.

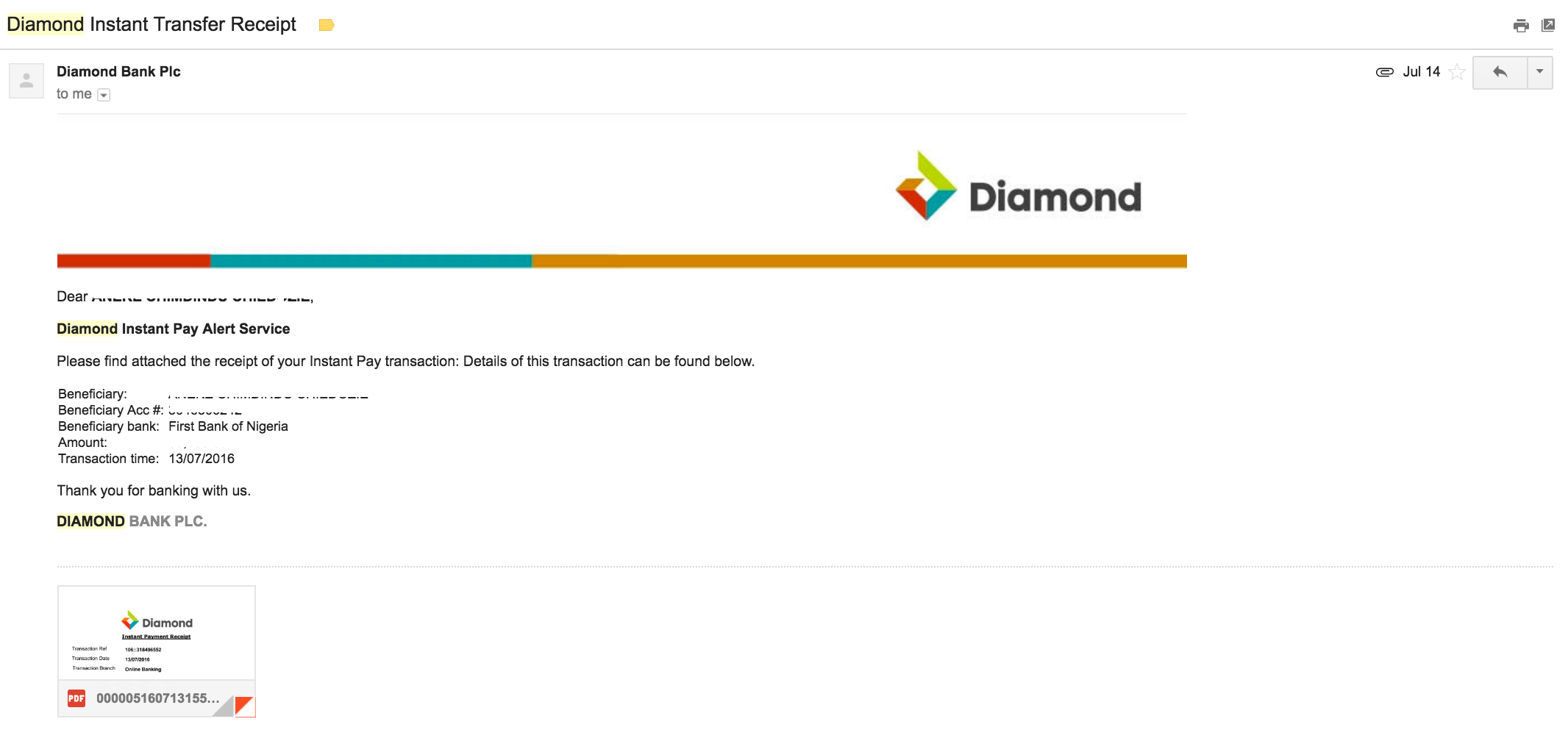

The 1 pre accounting tool for accountants and bookkeepers. Bank reconciliation records are updated using the date you entered in the bank transaction entry bank transfer entry reconcile bank adjustments or bank deposit entry windows. The receipt will have users name the date on which transaction occurred his account number and other account details along with the amount withdrawn by him in currency and the amount that is remaining in his account. How to reprint of receipt of any fees transaction ii l b i duration.

No more data entry. Businesses typically keep bank receipts until the end of the year so that the receipts can be used for tax preparation purposes. Bank receipt is a document issued by chinese banks to record the data for a single transaction posted on a bank account. If i didnt make the transaction id need to ring the bank in the usual way to get them to stop it and then change my passcode.

I still wouldnt use an internet cafe to access anything private but if someone had to in an emergency they would get alerts if their credentials were stolen. With receipts generated from ar cash receipt ap return or bank transaction entry. Chinese companies often use the data from bank receipts to do the follow on postings for vendor invoices or customer payments in. Individuals who claim tax deductions for certain kinds of expenses must also keep copies of bank receipts to.

Very useful if youre travelling abroad. Clear unused receipts used to clear receipt transaction to remove receipts from the system. Existing receipt that wont be assigned to a deposit because the amount has already been deposited the. Many people review their monthly bank statement and compare the amounts and transaction dates of items listed on the statement with their own bank receipts.