Artificial Intelligence In Banking Sector

However ai is a right balance of skill and emotions which is continually growing.

Artificial intelligence in banking sector. The most essential part of this industry is artificial intelligence in banking. 2019 12 17t192527z the letter f. Artificial intelligence provides banks financial institutions and tech companies with significant competitive advantages. Success stories of the 3 largest american banks.

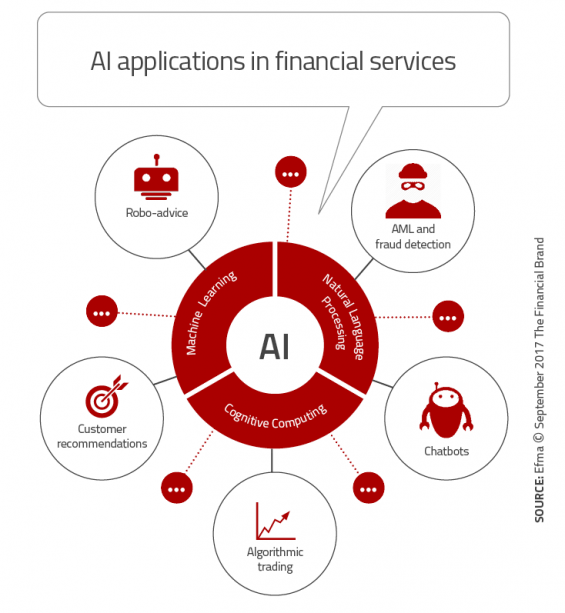

Artificial intelligence has clearly impacted this landscape with ai enabled chatbots and voice assistants now the norm at major financial institutions. Nevertheless it can completely transform the financial sector and make it faster but this will only be possible if the financial industry can manage the security risk of systems based on ai. If we compare it to the time when visiting a bank was the only way to withdraw money to the modern banking era where one click on a mobile banking app is all you need to do is to make a payment we know that the banking industry. Online payments hands keyboard.

Implementing artificial intelligence in banking sector. It indicates the ability to send an. The challenges introduced by the emergence of artificial intelligence revolve around several things. Continuous technological disruptions have changed the way the banking industry works drastically.

Were also seeing ai impact biometric authorization and for those who enjoy the occasional throwback visit to a physical bank ai enabled robotic help. The impact of artificial intelligence in the banking sector how ai is being used in 2020. The program was designed to analyze legal documents and extract important data points and clauses. It has a profound impact when the machine learning in banking industry can interact with humans by making decisions and in a convincing way encourage.

Closeup businessman working with generic design notebook. Impact of artificial intelligence for the future of banking sector.